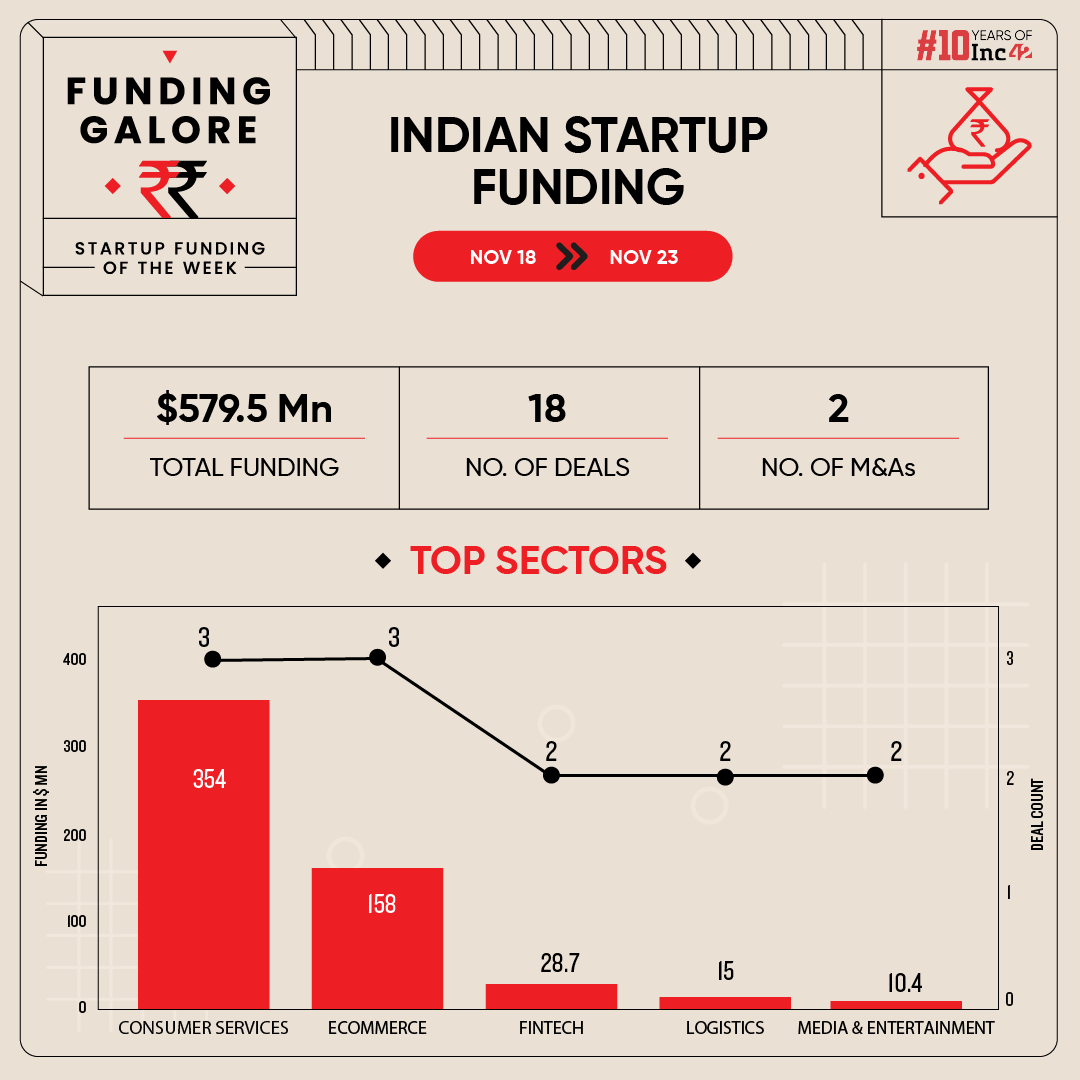

Indian startups cumulatively $579.5 Mn throughout 18 offers, a 212% improve from the $185.8 Mn raised throughout 21 offers within the earlier week

The week noticed two mega funding offers materialise for fast commerce startup Zepto and ecommerce HealthKart

Seed funding additionally jumped 85% to $10.9 Mn this week

After months of speculations, Zepto lastly sealed its third mega funding deal of the yr this week. The fast commerce unicorn’s $350 Mn funding spherical fuelled general funding momentum within the Indian startup ecosystem through the third week of November.

Between November 18 and 23, startups cumulatively raised $579.5 Mn throughout 18 offers. This marked a 212% improve from the $185.8 Mn raised throughout 21 offers within the previous week.

Funding Galore: Indian Startup Funding Of The Week [ Nov 18 – 23 ]

| Date | Title | Sector | Subsector | Enterprise Mannequin | Funding Spherical Measurement | Funding Spherical Kind | Traders | Lead Investor |

| 22 Nov 2024 | Zepto | Client Providers | Hyperlocal Supply | B2C | $350 Mn | – | Motilal Oswal, Taparia Household Workplace, Mankind Pharma Household Workplace, RP Sanjiv Goenka Group, Cello Household Workplace, Haldiram Snacks Household Workplace, Sekhsaria Household Workplace, Kalyan Household Workplace, Completely happy Forgings Household Workplace, Moms Recipe Household Workplace, Abhishek Bachchan, Sachin Tendulkar | Motilal Oswal |

| 18 Nov 2024 | HealthKart | Ecommerce | B2C Ecommerce | B2C | $153 Mn | – | ChrysCapital, Motilal Oswal Alternates, Neo Group, A91 Companion | ChrysCapital, Motilal Oswal Alternates |

| 21 Nov 2024 | Zopper | FIntech | Fintech SaaS | B2B | $25 Mn | Collection D | Elevation Capital, Dharana Capital, Blume Ventures | Elevation Capital, Dharana Capital |

| 21 Nov 2024 | Kratos Gaming Community | Media & Leisure | Gaming | B2C | $10 Mn | – | Aptos Labs, Polygon, Game7 | Aptos Labs |

| 20 Nov 2024 | Locad | Logistics | Built-in Logistics | B2B | $9 Mn | pre-Collection B | World Ventures, Reefknot Investments, Sumitomo Fairness Ventures, Antler Elevate, Febe Ventures, JG Summit | World Ventures, Reefknot Investments |

| 20 Nov 2024 | Blitz | Logistics | Ecommerce Logistics | B2B | $6 Mn | Collection A | IvyCap Ventures, IndiaQuotient, Alteria capital, Ramesh Bafna, Siddharth Dungarwal, Vinit Gautam, Amitabh Suri | IvyCap Ventures |

| 20 Nov 2024 | Billion Hearts Software program Applied sciences | Comsumer Tech | – | B2C | $4 Mn | Seed | Blume Ventures, Common Catalyst, Athera Enterprise Companions. | – |

| 21 Nov 2024 | CredFlow | FIntech | Fintech SaaS | B2B | $3.7 Mn | pre-Collection B | Inflexor Ventures | Inflexor Ventures |

| 19 Nov 2024 | Proost | Alcoholic Drinks | – | B2C | $3.5 Mn | Collection A | Chimes Group, Srinavasan Namala, Hyderabad Angels, The Chennai Angels | Chimes Group, Srinavasan Namala |

| 20 Nov 2024 | Doodhvale Farms | Ecommerce | D2C | B2C | $3 Mn | – | Atomic Capital, Singularity Early Alternatives Fund, Indigram Labs Basis, Ramakant Sharma, Ankit Tandon, Saurabh Jain, Arjun Vaidya | Atomic Capital, Singularity Early Alternatives Fund |

| 20 Nov 2024 | Abyom SpaceTech | Deeptech | Spacetech | B2B | $2.5 Mn | Seed | SCOPE Ventures | SCOPE Ventures |

| 19 Nov 2024 | Swish | Client Providers | Hyperlocal Supply | B2C | $2 Mn | Seed | Accel, Karthik Gurumurthy, Abhiraj Bhal, Varun Khaitan | Accel |

| 18 Nov 2024 | Biryani By Kilo | Client Providers | Hyperlocal Supply | B2C | $2 Mn | – | Pulsar Capital | Pulsar Capital |

| 19 Nov 2024 | Indic Wisdon | Ecommerce | D2C | B2C | $2 Mn | pre-Collection A | Rockstud Capital | Rockstud Capital |

| 19 Nov 2024 | Theranautilus | Deeptech | Robotics | B2B | $1.2 Mn | Seed | pi Ventures, Golden Sparrow Ventures, Abhishek Goyal, Lalit Keshre | pi Ventures |

| 20 Nov 2024 | Taqtics | Enterprisetech | Horizontal SaaS | B2B | $1.2 Mn | Seed | Sprout Enterprise Companions, Capital-A, Java Capital | Sprout Enterprise Companions, Capital-A |

| 18 Nov 2024 | Matrix Geo Options | Deeptech | Spacetech | B2B | $1 Mn | – | Chittorgarh Infotech Restricted, Viney Fairness Markets LLP, Tryrock Capital, Belief AIF | – |

| 19 Nov 2024 | Baanheim Ventures | Media & Leisure | Digital Media | B2C | $391K | – | Mudhal Companions | Mudhal Companions |

| Supply: Inc42 *Half of a bigger spherical Observe: Solely disclosed funding rounds have been included |

||||||||

Key Startup Funding Highlights Of The Week

- Fast commerce main Zepto reaffirmed its place as probably the most closely backed startup of the yr. Bagging a mega cheque of $350 Mn from buyers like Motilal Oswal, Sachin Tendulkar, Mankind Pharma Household Workplace this week, Zepto’s cumulative fundraise for the yr now stands at $1.3 Bn.

- On the again of Zepto’s fundraise, the buyer companies sector emerged because the investor favorite sector this week. Startups within the house bagged $354 Mn throughout three offers.

- Moreover Zepto, the week additionally noticed one other mega funding spherical materialise within the type of HealthKart’s $153 Mn fundraise. With this, the ecommerce sector noticed the second highest capital infusion this week. Startups within the house raised $163 Mn throughout three offers.

- Enterprise capitalist agency Blume Ventures was probably the most energetic investor this week, backing fintech startup Zopper and Mayank Bidawatka’s newest enterprise Billion Hearts.

- Seed funding continued its upward motion this week, with startups at this stage cumulatively bagging $10.9 Mn. This marked an 85% leap from the $5.9 Mn raised by startups at this stage final week.

Mergers & Acquisitions This Week

Updates On Indian Startup IPOs

- Reviews this week stated that B2B market startup OfBusiness has roped in Axis Capital, Morgan Stanley, JPMorgan, Citigroup and Financial institution of America for a close to $1 Bn IPO in 2025.

- With its public difficulty seeing an oversubscription of 1.86X, shares of logistics main BlackBuck received listed on the BSE and NSE this week at a premium of two.9%.

- Bhavish Aggarwal-led Ola Client initiated its IPO journey this week by receiving its shareholder nod to drop the phrase “non-public” from the corporate’s title.

Different Developments Of The Week

- IN-SPACe’s chairman Pawan Goenka informed Inc42 that the Centre-led INR 1,000 Cr spacetech fund is set to turn out to be operational by the primary quarter of fiscal yr 2025-26 (Q1 FY26).

- Photo voltaic options startup SolarSquare plans to boost $30 Mn at a $130 Mn valuation. This marks a 2.7X leap from its earlier valuation of $47.7 Mn.

- A secondary share sale at omnichannel eyewear unicorn Lenskart is more likely to worth $6 Bn, up 20% from its final valuation of $5 Bn.

- Hospitality unicorn OYO’s founder Ritesh Agarwal is seeking to infuse $65 Mn to extend his stake within the startup.

- Listed on-line journey aggregator MakeMyTrip will likely be buying fintech unicorn CRED’s expense administration platform Happay in a bid to turn out to be the go-to platform for complete company journey and expense administration options.

- Former Worldwide Finance Companies’s govt Sayan Ghosh launched his personal VC agency Ortella World Capital (OG Capital) this week together with a $36 Mn fund.

- IIT Bombay’s Society for Innovation & Entrepreneurship (SINE) will likely be launching its maiden VC fund with a goal corpus of $11.8 Mn. Via the fund, it goals to again 1,000 startups over the subsequent 10 years with a median ticket measurement of INR 2-15 Cr.