Titan Capital, based by Snapdeal’s Kunal Bahl and Rohit Bansal, has historically invested in startups on the seed or Collection A phases. Now, with its newest fund, the enterprise capital (VC) agency desires to solely make investments in follow-on rounds of a few of the top-performing firms from its portfolio of 280 startups. Furthermore, for Titan Capital, the extra capital will function a mark of confidence in its portfolio.

On Monday, the early-stage funding fund, which has invested in firms like Bhavish Aggarwal’s Ola Shopper (again when it was Ola Cabs) and Mamaearth, made the ultimate shut of its new fund at Rs 333 crore. The VC agency is trying to spend money on 20 startups with a median ticket measurement of Rs 15 crore.

Titan Capital has traditionally by no means relied on exterior capital and the Winners Fund marks the primary time the agency has opened its doorways to restricted companions (LPs) to spend money on its fund.

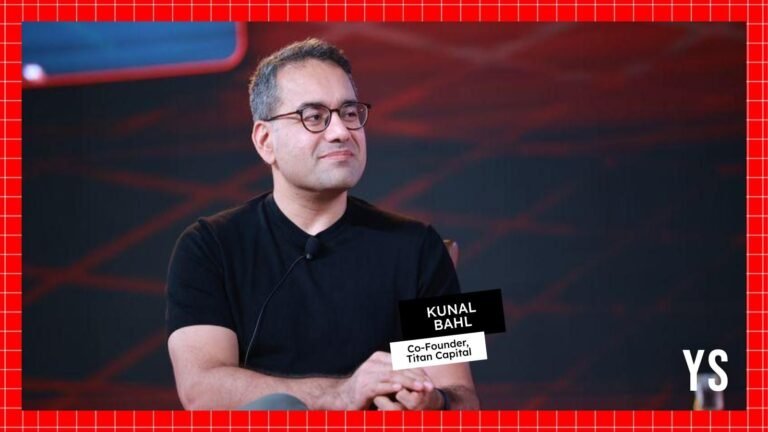

YourStory spoke with co-founder Bahl to know the technique behind the brand new fund and the way he hopes to reiterate the agency’s dedication to its portfolio firms amidst a rising pattern of enterprise funds transferring away from tech-enabled firms.

Edited excerpts:

YS: May you elaborate extra about your technique with the Winners Fund?

Kunal Bahl: Over the previous 13 years, Rohit Bansal and I’ve been actively investing our capital in round 280 firms—a journey that has confirmed fruitful. We now have had the privilege of supporting quite a few distinctive founders and their ventures, persevering with this assist by way of our Titan Seed Fund whereby we’re nonetheless investing our personal proprietary capital. This ongoing dedication displays our perception within the potential of those startups and our dedication to fostering their progress.

As time progressed, we noticed two vital traits.

First, the founders in our portfolio expressed their appreciation for our early perception of their imaginative and prescient, encouraging us to extend our investments in subsequent funding rounds. This suggestions highlighted the power of {our relationships} and the belief we had constructed. Concurrently, many people throughout the ecosystem—fellow founders and people with sizable household places of work—started reaching out to specific curiosity in co-investing alongside us, recognising our sturdy deal circulate and a eager eye for promising firms.

To handle the challenges of coordinating these investments whereas respecting the founders’ preferences, we conceived the Winners Fund. This capital amplification car permits us to anchor the fund as its largest traders, collaborating with like-minded people to spend money on the standout firms throughout the Titan Seed Fund portfolio that we already know nicely, making it a really perfect alternative for us to double down on our greatest prospects.

YS: Are you able to give us a way of who the LPs are for the Winners Fund?

Kunal Bahl: It is primarily many giant, reputed household places of work, CEOs of huge listed firms, and lots of founders as nicely from the startup ecosystem who’ve scaled good companies. So it is a mixture.

YS: Is the capital being raised domestically?

Kunal Bahl: It’s predominantly home capital. I really feel very passionately about activating home capital.

The latest knowledge reveals that solely 15% of startup funding in India final 12 months got here from home sources. This example wants to vary, as a robust basis of home capital is important for a secure startup financial system. With out it, we threat being overly influenced by the fluctuations of world financing markets, which might create uncertainty for native companies.

As seasoned traders with in depth expertise and a portfolio of firms, we now have gained useful insights and established varied funding autos. This experience not solely bolsters our confidence but additionally serves as encouragement for others eager about investing within the home monetary markets and startup ecosystem however lack credible avenues to take action. It’s essential to activate and mobilise extra home capital in India to assist startups, making certain a sturdy and resilient monetary panorama for rising enterprises.

YS: Do you see the pattern of mobilising extra home capital rising?

Kunal Bahl: It’s only a matter of time. It’s already growing however I’d love for it to extend extra. I really feel that 85% of the capital dependency continues to be on international capital. That can’t be nice. It topics the startup ecosystem’s destiny to hold within the steadiness of world monetary markets, even when India is a macro brilliant spot.

So, I hope and need that different good traders additionally give a chance to home capital to take part within the startup financial system.

YS: What’s your thesis in figuring out the proper firms to spend money on?

Kunal Bahl: We categorise our funding method into three key buckets.

First, we prioritise nice founding groups which have demonstrated success in varied fields, whether or not it is dance, music, artwork, lecturers, or earlier enterprise ventures. A powerful monitor report signifies the potential for future achievements, which is essential within the startup panorama.

Secondly, we deal with fascinating market areas, particularly firms focusing on what I name ‘laughably small TAM (Complete Addressable Market)’. These are area of interest areas the place companies can utilise restricted sources to ascertain dominance, earn shopper belief, and subsequently increase into broader classes.

The third bucket emphasises the significance of producing strong unit economics, as they symbolize the core of any enterprise. If the unit economics aren’t correctly established within the early phases, it turns into difficult to rectify them later with out essentially altering the enterprise. Moreover, we preserve a precept of investing solely in sectors we perceive deeply, primarily specializing in tech-enabled companies in areas similar to marketplaces, logistics, SaaS, fintech, and new-age shopper manufacturers the place we now have appreciable expertise.

YS: Titan Capital has backed tech-enabled firms and understands these enterprise fashions nicely. Nonetheless, there was a latest outcry about there being no cash for growth-stage firms in India. Is that one thing you’ll need to deal with going ahead?

Kunal Bahl: We aren’t visionary folks. We won’t consider the longer term. There is a saying that goes: you begin with the mandatory, then you definately transfer to what’s attainable, after which earlier than you realize it, you are doing the inconceivable. So, we first simply begin with the mandatory.

We simply felt that this was for us and for the founders of the Titan household. The founders have been coming and telling us themselves that, ‘look, once we exit to lift cash, what can be nice for us is we get an exterior investor to cost the spherical, to guide the spherical, and also you fill-up the remainder of the spherical.’

We do not have to do an excessive amount of mind injury working round looking for traders to fill the spherical. It simply felt like a really natural pull, like one thing that appeared vital for our founders.

Proper now there is not any different, like, long-term plan of establishing a progress capital car.

YS: Will Titan Capital additionally look past tech-enabled sectors like most VCs immediately?

Kunal Bahl: No, truly we simply look to spend money on firms that are in our circle of competence. It doesn’t imply that if we do not perceive it, it isn’t a superb firm to spend money on. Perhaps another person understands it higher than we do.

So, our view is that we do not must be in all the nice firms as traders. We simply want to verify the businesses we have invested in are good. That is it. As a result of in case you maintain investing in firms which might be good, you’ll generate good returns which you’ll be able to then reinvest to again the following cohort of sectors.

So, we do not really feel any concern of lacking out on sizzling areas. We do not actually spend money on waves and areas. Whereas the macros are essential, we largely spend money on the micros.

YS: By when does Tital Capital anticipate to disperse your complete fund?

Kunal Bahl: There isn’t a strict timeline as such however roughly round 2-3 years. It is dependent upon if extra firms mature quicker, we’ll make investments quicker. If it takes longer, we’ll take longer to take a position. However we now have no such strain to take a position rapidly or want to take a position very slowly both. We are going to do it on an natural foundation.

YS: The agency mentioned there are 2-3 offers within the pipeline as a part of your Winners Fund which might be within the ultimate phases. May you trace at what sectors these firms are in?

Kunal Bahl: There’s one firm within the business-to-business (B2B) house. There’s one other within the building materials house and one other within the fast service restaurant (QSR) house.